Sovereign Adjustments is a National company with extensive knowledge in our industry.

WE OFFER PUBLIC ADJUSTMENT SERVICES AND HAVE CERTIFIED PROPERTY INSURANCE APPRAISERS TO SERVICE OUR CLIENTS.

SAE represents clients in CT, GA, IN, KY, MS, NC, NJ, NY, RI, and SC

Dealing with disaster, no matter what form it takes, is grueling and difficult. But beyond the physical and emotional damage of a life-changing event lies the pressure of working with insurance companies. It is imperative to have a trusted, knowledgeable ally when going through the insurance adjustment process. Handling your insurance claim properly can mean the difference between getting the best settlement and walking away empty handed. Sovereign Adjustments East is a fully comprehensive solution for your insurance adjustment needs – we are your representative, your sponsor, and your support system.

Sovereign Adjustments East is a national company with extensive knowledge in the insurance claims business. We have been skillfully handling claims for nearly 10 years, and our team boasts several decades of industry experience. Just as you would no go to court without a lawyer, we believe that you should not go through insurance negotiations without an expert. We deal with insurance companies more efficiently by knowing all the insurance regulations that vary from state to state. Our expert knowledge in regulatory standards and compliance will protect you from unfair tactics by your carrier, and we will fight to negotiate the largest possible settlement on your behalf.

We are known for our dedication to our clients, and we work tirelessly to protect their best interests. Sovereign Adjustments East has the capacity to handle any claim, from fire and flood damage to theft and vandalism. We work individually with each of our clients and act as a liaison with their insurance companies. Our goal is to work quickly and efficiently to reach the best possible settlement. Accidents never happen on schedule. That’s where we come in – our team can react quickly to residential or commercial property damage and get to work on processing your settlement immediately.

We understand that knowledge is essential when dealing with property damage. A typical fire or flood policy contains hundreds of provisions and stipulations, constantly changing forms and endorsements, and complex details such as inventory appraisals and real estate evaluations. Most policyholders are not versed in these complicated regulations, and are unaware that the burden of proof is theirs. Sovereign Adjustments East is able to even the playing field between you and the insurance company. Most people are at a disadvantage when negotiating with insurance companies. As public adjusters, we understand the inner workings of the insurance business and will be there for every step of the process. Our team will help prepare your claim, present it the insurance company, and represent your interests at every inspection and meeting. As a result, we are able to expedite your payments and get you back on your feet fast.

As insurance adjusters, our team is deeply embedded in the communities we serve. We are a member of the National Association of Public Insurance Adjusters and proud executive board member of the New York State Public Adjusters Association. We also sit on municipal boards with the people we work with every day in order to forge better working relationships. We believe in giving back, too, and have proudly been on the regional board for Easter Seals for several years.

At Sovereign Adjustments East, we truly believe that you can’t put a price on caring. Helping people put their lives back together after a loss is not just our job, it’s our duty. We are dedicated to working for you in order achieve a streamlined claims process and a fair settlement. Let our expertise guide you through this difficult process with ease and peace of mind.

| State | Personal License # | Corporate License # | National Producer Number (NPN) |

| CT | 2406859 | 2408224 | 16146223 |

| GA | 3096605 | 16146223 | |

| IN | 3201146 | 16146223 | |

| KY | 942450 | 16146223 | |

| MS | 10449122 | 16146223 | |

| NC | 16146223 | 16146223 | |

| NJ | 1301866 | 1415377 | 16146223 |

| NY | PA-1156078 | 1245179 | 16146223 |

| RI | 2339581 | 16146223 | |

| SC | 829454 | 16146223 |

Sovereign Adjustments East is a fully comprehensive solution for your insurance adjustment needs. Our 7-Step adjustment process ensures that we serve your needs to negotiate the largest settlement possible on your behalf.

I. Evaluate existing insurance policies to determine what coverage apply to a claim

II. Research, detail, and substantiate damage to buildings, contents, and any additional expenses

III. Evaluate business interruption losses and extra expense claims

IV. Determine values for settling covered damages

V. Prepare, document, and support the claim on behalf of the insured

VI. Negotiate a settlement with the insurance company

VII. Re-open a claim and negotiate for more money after the claim has been settled

if a discrepancy is found

As Public Adjusters, we help people to put their lives back together after suffering a property loss. Dealing with the insurance company is our responsibility. As licensed Public Adjusters, we will assist in the negotiation of your claim to reflect the Home Owner's or Business Owner's best interest. We are present at every town, insurance company, and bank inspection to ensure the rebuilding of your home is constantly monitored. We truly believe you can't put a price on caring.

High winds are a primary cause of hurricane-inflicted loss of life and property damage. Another cause is the flooding resulting from the coastal storm surge of the ocean and the torrential rains, both of which accompany the storm.

Your insurance policy is a contract that an insurance company agrees, for a premium, to provide benefits, reimburse losses or provide services for you as the insured/policyholder. This agreement is called a contract, which is a legally binding agreement between two or more parties enforceable in a court of law.

Any damage to your home or property will be covered UNLESS it comes under one of the following exclusions:

For homeowners insurance policies there is liability coverage (for expenses you might incur if someone is injured on your property) and loss of use coverage if you need to vacate your home due to a covered loss.

One other note, there are certain limits on coverage for some items or contents of your home that you may need to get an “endorsement” for in order to be adequately covered for a loss, such as jewelry, computer equipment, silverware, coins, etc.

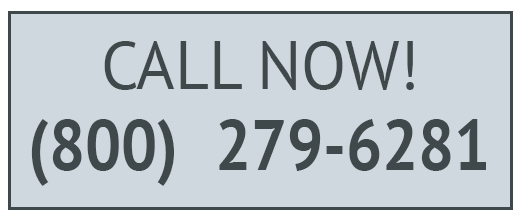

Get in touch with us